– Corporate governance – Board of Directors

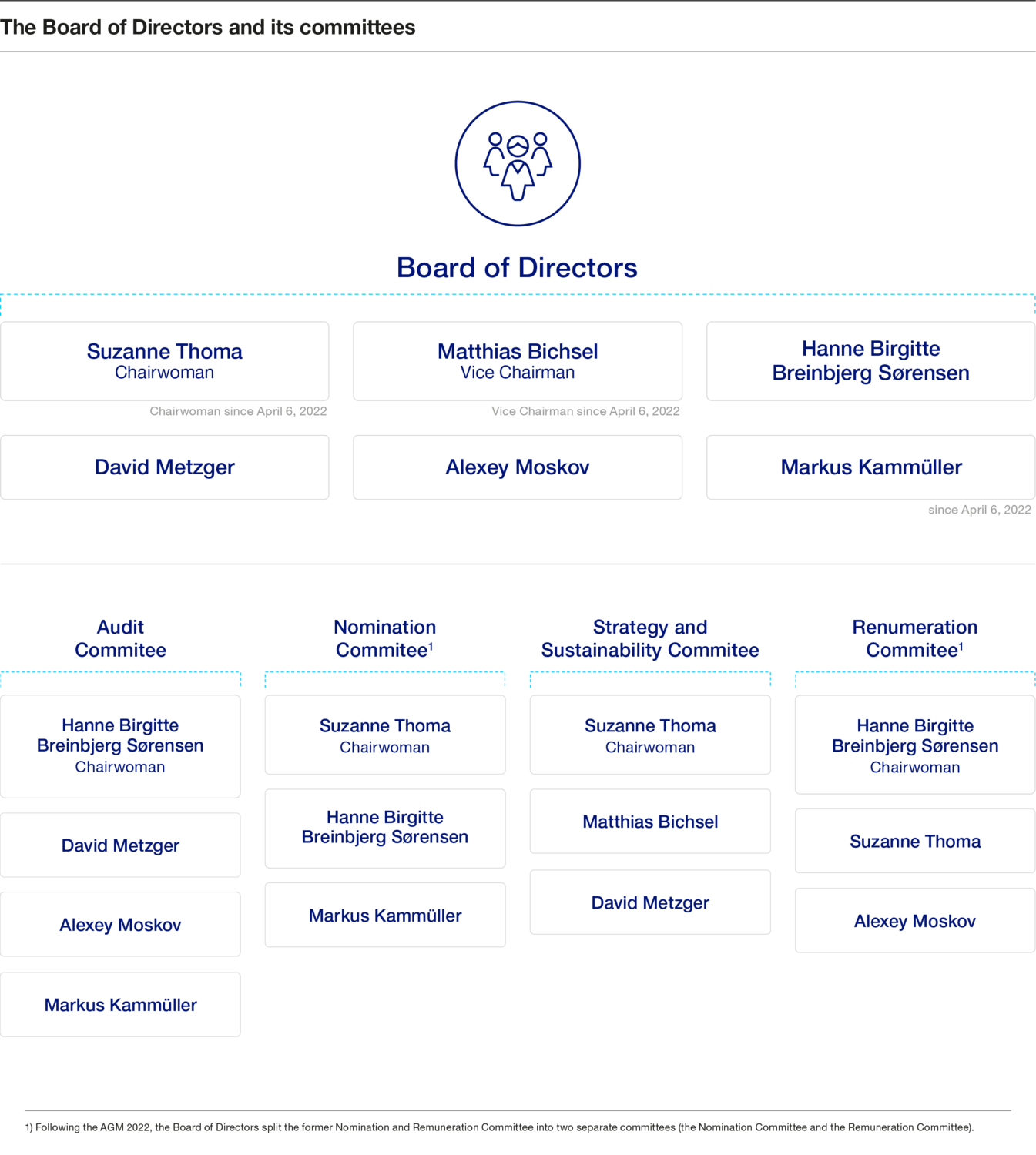

Board of Directors

Members of the Board of Directors are elected individually for a term until the end of the next AGM. At the AGM of April 6, 2022, Peter Löscher, Mikhail Lifshitz and Gerhard Roiss did not stand for re-election. All other members were re-elected. Suzanne Thoma was elected as Chairwoman of the Board of Directors. In addition, Markus Kammüller was elected as a new member of the Board of Directors. The Board consists of six members. Except for Suzanne Thoma, who was also appointed the company’s CEO as of November 1, 2022, and became the Executive Chair, none of the members of the Board of Directors has ever held an executive position at Sulzer.

Apart from Executive Chair Suzanne Thoma, all members of the Board of Directors are non-executive. None of the non-executive members of the Board of Directors have ever belonged to the management of a Sulzer company or to the Executive Committee, nor do any significant business relationships exist between members of the Board of Directors and Sulzer Ltd or a subsidiary of Sulzer Ltd.

Elections and terms of office

The Articles of Association stipulate that the Board of Directors of Sulzer Ltd shall comprise five to nine members. Each member is elected individually. The term of office for members of the Board of Directors lasts until the next AGM. At the AGM of April 6, 2022, five Board members were re-elected to the Board of Directors. Peter Löscher, Mikhail Lifshitz and Gerhard Roiss did not stand for re-election. Markus Kammüller was elected as additional member of the Board of Directors. The Board consists of six members: one from Cyprus/Israel, one from Denmark, one from France/Switzerland and three from Switzerland. Professional expertise and international experience played a key role in the selection of the members. The members of the Board of Directors and their CVs can be viewed below. Details of the former members of the Board of Directors can be viewed at www.sulzer.com/former-BoD-members.

According to the Board of Directors and Organization Regulations, the term of office of a Board member ends no later than on the date of the AGM in the year when the member reaches the age of 70. The Board of Directors can make exceptions up to but not exceeding the year in which the member reaches the age of 73.

Internal organization

The Board of Directors constitutes itself, except for the Chairperson of the Board of Directors who is elected by the Shareholders’ Meeting. The Board of Directors appoints from among its members the Vice Chairperson of the Board of Directors and the members of the board committees, except for the members of the Remuneration Committee, who are elected by the Shareholders’ Meeting. There are currently four standing board committees (for their constitution, see below):

- The Audit Committee (AC)

- The Nomination Committee (NC)1

- The Remuneration Committee (RC)1

- The Strategy and Sustainability Committee (SSC)

1 The Nomination and Remuneration Committee was split into two separate committees after the 2022 AGM on April 6, 2022.

The Board of Directors and Organization Regulations and the relevant Committee Regulations, which are published under corporate governance (see "Regulations"), define the division of responsibilities between the Board of Directors and the Executive Committee. They also define the authorities and responsibilities of the Chairperson of the Board of Directors and of the four standing board committees.

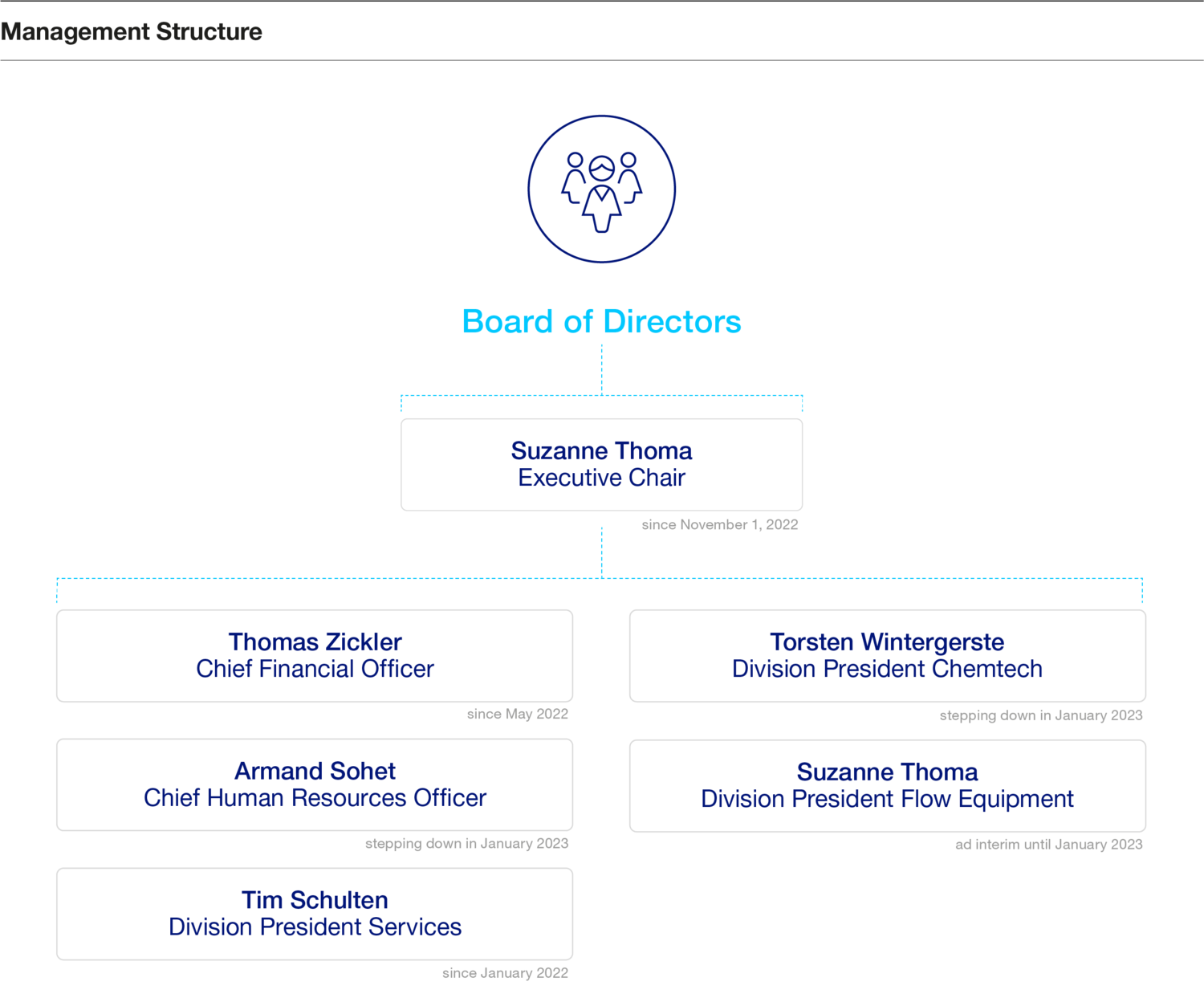

Appointment of an Executive Chair

The Board of Directors appointed its Chairwoman, Suzanne Thoma, as Executive Chair of Sulzer as of November 1st, 2022. In this role, she assumed operational management of the Company and also took over the responsibilities of the CEO. The Board of Directors identified a need for action in view of the constantly evolving market environment and the associated structural shift in demand in the energy and infrastructure sectors. Therefore, the Board has tasked Suzanne Thoma with conducting a thorough review and comprehensive realignment of Sulzer’s strategy. To ensure optimal cooperation and transparency between the Board of Directors and the Executive Committee in these fluctuating market conditions, the Board of Directors entrusted Suzanne Thoma with managing Sulzer as a whole in an executive chair model.

Outlook governance framework changes

To ensure an appropriate governance framework and to ensure checks and balances in an executive chair governance model, the Board has decided to take measures and to strengthen its corporate governance framework by establishing a separate, standing corporate governance committee and by appointing a lead independent director, who will chair the governance committee. Subject to being re-elected to the Board at the 2023 AGM, the Board intends to entrust its current member Markus Kammüller with the position of lead independent director. The lead independent director shall ensure, on behalf of the Board of Directors, that the rules of good corporate governance are adhered to in the decision-making of the Board. In this context, the lead independent director may call for and chair meetings of the non-executive Board members whenever required. He should also act as a point of contact for members of the Board to discuss matters regarding the Company’s corporate governance that they would like to raise in the absence of the Executive Chair.

The governance committee will consist of three non-executive and independent Board members and will meet at least once annually. The governance committee will support the Board of Directors in fulfilling its duties by providing independent advice to the Board of Directors with respect to checks and balances in a governance model where certain Board members have executive functions. Within this scope, the governance committee oversees the Company’s compliance with the Swiss Code of Best Practice for Corporate Governance, its internal organizational regulations as well as applicable legal, regulatory and listing requirements in terms of corporate governance and advises the Board on these aspects. It will periodically review the principles of corporate governance and counsel the Board of Directors with regard to significant developments in the law and best practice of good governance. Furthermore, the governance committee will act as a sounding board for the lead independent director.

Due to her appointment as Executive Chair, Suzanne Thoma will step down as member of the Remuneration Committee and as chair of the Nomination Committee, on which she will continue to serve as a regular member only and which will further consist of two non-executive, independent members of the Board of Directors after the 2023 AGM.

CVs of members of the Board of Directors

Dr. Suzanne Thoma1

Chairwoman of the Board

Chairwoman of the Nomination Committee and the Strategy and Sustainability Committee

Member of the Remuneration Committee

Educational background

- Ph.D. in Technical Sciences, ETH Zurich, Switzerland

- Master of Science degree in Chemical Engineering, ETH Zurich, Switzerland

- Bachelor’s degree in Business Administration, Graduate School of Business Administration (GSBA), Zurich, Switzerland

Binding interests

- Member of the Board of Directors, BayWa r.e., Munich

- Member of the Board of Directors, Swiss Ventures Group, Zurich

- Vice President of the foundation “Avenir Suisse”, Switzerland

Career

Dr. Suzanne Thoma (Switzerland) was elected as member of Sulzer’s Board of Directors in 2021 and as Chairwoman in 2022. In addition, Suzanne Thoma was appointed Executive Chairwoman of Sulzer as of November 1, 2022. From 2013 to 2022, she was CEO of BKW AG, Berne, Switzerland. Prior to being appointed CEO of BKW, she was a member of the Group Executive Committee of BKW, responsible for the Networks division. Before that, she was head of the Automotive division of the WICOR Group, Rapperswil-Jona, Switzerland, and CEO of Rolic Technologies Ltd., Allschwil, Switzerland. Suzanne Thoma also served in various management roles and countries at Ciba Specialty Chemicals Ltd. (now BASF).

1) Chairwoman since April 6, 2022, and Executive Chair since November 1, 2022

Matthias Bichsel1

Member of the Board, Vice Chairman2

Member of the Strategy and Sustainability Committee3

Educational background

- Ph.D. in Earth Sciences, University of Basel, Switzerland

- Honorary professor, Chinese University of Petroleum, China

Binding interests

- Member of the Board of Directors, Petrofac, UK

- Member of the Advisory Board, Chrysalix EVC, Canada

- Member of the Board of Directors, Canadian Utilities Ltd, Canada

- Member of the Board of Directors, Southpole Holding, Switzerland

- Member of the Board of Directors, Voliro AG, Switzerland

Career

Matthias Bichsel (Switzerland) joined the Sulzer Board of Directors in 2014. Currently, he is member of the Board of Directors of Petrofac, UK (since 2015), member of the Board of Directors of South Pole Holding, Switzerland (since 2015), member of the Board of Directors of Canadian Utilities, Canada (since 2014), member of the Board of Directors of Voliro AG, Switzerland (since 2021) and member of the Advisory Board of Chrysalix EVC, Canada (since 2015). From 2009 to 2014, he was member of the Executive Committee of Royal Dutch Shell plc and Director of its Projects and Technology Business, the Netherlands. Previously, during his international career with Shell since 1980, he served in various senior management roles such as Executive Vice President in Exploration and Production, the Netherlands, CEO/Chairman of Shell International Exploration and Production Inc and Managing Director of Shell Deepwater Services, Houston, TX, USA.

1) Not standing for re-election at the AGM 2023

2) Since April 6, 2022

3) Chairman until April 6, 2022, member since April 6, 2022

Alexey Moskov

Member of the Board

Member of the Remuneration Committee1

Educational background

- Master’s degree in Software Engineering/Developing from the Moscow State University of Railway Engineering, Russia

Binding interests

- Member of the Board of Directors, Witel Ltd (formerly Renova Management Ltd), Switzerland

- Member of the Board of Directors, OC Oerlikon, Switzerland

- President of the Board of Directors, Liwet Holding AG, Switzerland (as of 2022)

- Chairman of the Board of Directors, A2-Link AG, Switzerland

Career

Alexey Moskov (Cyprus and Israel) was elected as new member of the Sulzer Board of Directors in 2020. As of 2022, he is President of the Board of Directors of Liwet Holding AG. Since 2018, Alexey Moskov is the sole member of the Board of Directors of Witel Ltd, Switzerland. Since 2016 he has been a member of the Board of Directors of OC Oerlikon and from 2019 until 2020 of Swiss Steel Holding. From 2004 to 2018, he was Chief Operating Officer of Renova Management AG, Switzerland. Previously, he served as Vice-President and member of the Executive Board at Tyumen Oil Company (now TNK-BP), Russia, and as member of the Board of Directors of OAO NGK Slavneft, Russia (1998–2004).

1) Since April 6, 2022

Hanne Birgitte Breinbjerg Sørensen1

Chairwoman of the Audit Committee and the Remuneration Committee2

Member of the Nomination Committee

Educational background

- MSc in Economics and Management, University of Aarhus, Denmark

Binding interests

- Member of the Board of Directors, Tata Motors Ltd., India

- Member of the Board of Directors, Ferrovial S.A., Spain

- Member of the Board of Directors, Holcim Ltd., Switzerland

- Member of the Board of Directors, Jaguar Land Rover Automotive PLC, United Kingdom

- Member of the Board of Directors, Tata Consultancy Services Ltd., India

Career

Hanne Birgitte Breinbjerg Sørensen (Denmark) joined the Sulzer Board of Directors in 2018. In 2017, she was interim CEO of V.Group Limited, the world’s largest ship management and marine service company headquartered in London. From 1994 to 2016, she held various positions within the A.P.Moller – Maersk A/S Group in Denmark, a conglomerate of several companies primarily within the energy and transportation industry: CEO of Damco, the Netherlands (2014–2016), CEO of Maersk Tankers, Denmark (2012–2013), Senior VP and Chief Commercial Officer of Maersk Line, Denmark (2008–2012)

1) Not standing for re-election at the AGM 2023

2) Chairwoman since April 6, 2022

David Metzger

Member of the Board

Member of the Strategy and Sustainability Committee1 and Audit Committee

Educational background

- Master of Business Administration from INSEAD Business School

- Master of Finance (lic. oec. publ.), University of Zurich

Binding interests

- Member of the Board of Directors, Swiss Steel Holding AG, Switzerland

- Member of the Board of Directors, Octo Telematics, Italy

- Member of the Board of Directors, medmix AG, Switzerland

Career

David Metzger (Switzerland and France) was elected as member of Sulzer’s Board of Directors in 2021. He is currently Managing Director Investments and Portfolio Manager for Liwet Holding AG. Prior to this David Metzger held senior positions in Witel AG, and previously the Renova Group, as Deputy Managing Director M&A and Strategic Investment at Renova Management AG, and Chief Financial Officer of Venetos Management AG (part of the Renova Group). Prior to this, he held various roles at Good Energies Inc., Bain & Company, Novartis, and Morgan Stanley.

1) Member since April 6, 2022

Markus Kammüller1

Member of the Board

Member of the Nomination and the Audit Committee

Educational background

- Degree in Business Administration, University of Applied Sciences, Lucerne, Switzerland

Binding interests

- Member of the Board of Directors, Gonset Holding SA, Gonset Immeubles d’Entreprises SA and Gonset Immeubles Résidentiels SA, Switzerland

Career

Markus Kammüller (Switzerland) joined the Sulzer Board of Directors in 2022. He is the founder and owner of ExecDelta GmbH, a company specialized in transformation and change-management consulting. Prior to establishing his own business in 2019, he held the position of Global Head of Transformation at BDO International, Brussels (2016 to 2019). Before that, he was a Partner at PwC in the role of EMEA Chief Operating Officer and Global Change Management Leader (2006 to 2016). He also held various managerial positions at IBM Switzerland (2002 to 2006) and PwC Consulting (1996 to 2002) where he was a Partner and acted as senior advisor for large listed international corporations. From 1985 to 1996 he held various roles in finance, treasury and risk management at The Dow Chemical. From 1978 to 1982 he worked in the credit department of Swiss Volksbank.

1) Since April 6, 2022

Operating principles of the Board of Directors and its committees

All decisions are made by the full Board of Directors. For each application, written documentation is distributed to the members of the Board of Directors prior to the meeting. The Board of Directors and the committees meet as often as required by the circumstances. The Board of Directors meets at least five times per year; the Audit Committee, the Remuneration Committee, the Nomination Committee and the Strategy and Sustainability Committee meet at least twice per year. In 2022, the Board held eight meetings, one additional meeting for the constitution of the Board after the AGM and nine video/conference calls lasting from five minutes to eight hours. For further details, see the table below. The CFO and the Group General Counsel as well as the Secretary of the Board of Directors also generally attend the Board meetings in an advisory role. Other members of the Executive Committee are invited to attend Board meetings as required to discuss the midterm planning, the strategy and the budget, as well as division-specific items (such as large investments and acquisitions). In exceptional cases, external consultants (e.g., legal advisors, management consultants or executive compensation experts) are also invited for the presentation or discussion of specific agenda items in meetings of the Board of Directors or any of its committees.

The committees do not make any decisions, but rather review and discuss the matters assigned to them and submit the required proposals to the full Board of Directors for a decision. At the next full Board meeting following the committee meeting, the Chairpersons of the committees report to the full Board of Directors on all matters discussed, including key findings, opinions and recommendations.

Board of Directors

|

|

|

|

|

|

|

|

|

|

|

Attending meetings of the |

||||||||||

|

Name |

|

Nationality |

|

Position |

|

Entry |

|

Elected until |

|

Board |

|

AC |

|

NC |

|

SSC |

|

RC |

|

NRC 4) |

|

Suzanne Thoma |

|

Switzerland |

|

Chairwoman, Chairwoman SSC and NC, member RC |

|

April 2021 1) |

|

2023 |

|

17 |

|

- |

|

3 |

|

4 |

|

3 |

|

2 |

|

Matthias Bichsel |

|

Switzerland |

|

Vice Chairman of the Board, member SSC |

|

March 2014 2) |

|

2023 |

|

18 |

|

- |

|

- |

|

4 |

|

- |

|

- |

|

David Metzger |

|

Switzerland / France |

|

Member AC, member SSC |

|

April 2021 |

|

2023 |

|

18 |

|

5 |

|

- |

|

3 |

|

- |

|

- |

|

Alexey Moskov |

|

Cyprus / Israel |

|

Member RC |

|

April 2020 |

|

2023 |

|

15 |

|

1 |

|

- |

|

- |

|

3 |

|

- |

|

Hanne Birgitte Breinbjerg Sørensen |

|

Denmark |

|

Chairwoman AC, chairwoman NC |

|

April 2018 |

|

2023 |

|

18 |

|

5 |

|

3 |

|

- |

|

3 |

|

2 |

|

Markus Kammüller |

|

Switzerland |

|

Member of the NC and the AC |

|

April 2022 |

|

2023 |

|

15 |

|

4 |

|

3 |

|

- |

|

- |

|

- |

AC = Audit Committee, NC = Nomination Committee, SSC = Strategy and Sustainability Committee, RC = Remuneration Committee, NRC = Nomination and Remuneration Committee

1) Chairwoman since April 6, 2022

2) Vice Chairman since April 6, 2022 and until April 19, 2023

3) Split into the NC and RC after AGM 2022

Additional mandates of members of the Board of Directors outside the Sulzer Group

According to Sulzer’s Articles of Association, the maximum number of additional mandates held by members of the Board of Directors outside the Sulzer Group is ten (of which a maximum of four mandates may be with listed companies) (§ 33). Exceptions (e.g. for mandates held at the request of Sulzer or mandates in charitable organizations) are defined in the Articles of Association (§ 33 paragraphs a, b and c). All members of the Board of Directors are within the limits for external mandates prescribed by the Company’s Articles of Association.

Audit Committee

The Audit Committee (members listed above) assesses the midyear and annual consolidated financial statements and activities of the internal and statutory auditor, including effectiveness and independence, as well as the cooperation between the two bodies. It also assesses the Internal Control System (ICS), risk management and compliance; at least one meeting per year is dedicated to risk management and compliance. The regulations of the Audit Committee can be viewed at www.sulzer.com/ac-regulations. The CFO, the Group General Counsel, the Head of Group Internal Audit (who is also the Secretary of this committee) and the external auditor-in-charge attend the meetings of the Audit Committee. The Executive Chair may attend the meeting unless advised otherwise by the Head of Internal Audit. In 2022, the Audit Committee held five regular meetings, one in February, two in July, one in September and one in December. The meetings lasted, on average, between one and two and a half hours. The statutory auditor attended all of these meetings. Internal experts, such as the Group General Counsel and the Heads of Group Internal Audit, Group Corporate Finance, Group Accounting, Group IT, Group Compliance and Risk Management, and Group Tax gave presentations to the Audit Committee in 2022. In February, the Audit Committee is informed of compliance exposures as a result of periodic risk assessments, and it receives an overview of compliance cases under investigation. In September, the Audit Committee is briefed on the present state of risk management within the Company and on the results of the risk management process – a process to systematically identify and evaluate significant risks and introduce countermeasures. In the same meeting, an update on Sulzer’s compliance approach, including the respective ongoing – and planned – activities, is provided. The major current compliance cases (if any) are reported to and discussed by the Audit Committee regularly.

Nomination Committee

The Nomination Committee (members listed above) assesses the criteria for the election and re-election of Board members and the nomination of candidates for the top two management levels and deals with succession planning. The Executive Chair and the Chief Human Resources Officer (who is also the Secretary of this committee) attend the meetings of the Nomination Committee. In 2022, three regular meetings were held in July, September and December, taking on average one hour. The regulations of the Nomination Committee are available at www.sulzer.com/nc-regulations.

Remuneration Committee

The Remuneration Committee assesses the compensation systems and recommends compensation for the members of the Board of Directors and the Executive Committee (including bonus targets for the latter) on behalf of the Board of Directors and in accordance with its specifications. It carries out broad-based compensation benchmarks with an international comparison group, supported by studies of consulting firms such as Mercer and Willis Towers Watson, and it scrutinizes the work of internal and external consultants. The members of the Remuneration Committee are elected by the Shareholders’ Meeting. In 2022, three regular meetings were held in July, September and December, taking on average one hour. The regulations of the Remuneration Committee can be viewed at www.sulzer.com/rc-regulations.

Strategy and Sustainability Committee

The Strategy and Sustainability Committee (members listed above) advises the Board of Directors on strategic matters (such as material acquisitions, divestitures, alliances and joint ventures), strategic planning, definition of development priorities, and the Company’s sustainability initiatives and objectives as well as on other relevant public policy matters. The regulations of the Strategy and Sustainability Committee can be viewed at www.sulzer.com/ssc-regulations. In 2022, four regular meetings and one extraordinary meeting took place in February, May, June and October, lasting one and a half to two and a half hours.

Division of powers between the Board of Directors and the Executive Committee

The Board of Directors has largely delegated executive management powers to the Executive Committee. However, it is still responsible for matters that cannot be delegated in accordance with Art. 716a of the Swiss Code of Obligations. These matters include corporate strategy, the approval of midterm planning and the annual budget, as well as key personnel decisions and the preparation of the compensation report. The same applies to acquisition and divestiture decisions involving a transaction value exceeding CHF 30 million, investments in fixed assets exceeding CHF 15 million, major corporate restructurings, approval of dispute settlements with an impact on operating income of more than CHF 20 million, approval of research and development projects exceeding CHF 10 million, as well as other matters relevant to the Company, and decisions that must be made by law by the Board of Directors. The competency regulations and the nature of the collaboration between the Board of Directors and the Executive Committee can be viewed in the Board of Directors and Organizational Regulations at www.sulzer.com/BoD-organizational-regulations.

Information and control instruments

Each member of the Board of Directors receives a copy of the monthly financial information (January to May and July to November), plus the midyear and annual financial statements. These include information about the balance sheet, the income and cash flow statements, and key figures for the Company and its divisions. They incorporate comments on the respective business results and a rolling forecast for the current business year. The Executive Chair and the CFO report at every Board meeting on business developments and all matters relevant to the Company; once each year, the Board receives the forecasted annual results. During these Board meetings, the Chairs of the committees also report on all matters discussed by their committees and on the key findings and assessments, and they submit proposals accordingly. Each year, the Board of Directors discusses and approves the budget for the following year and the midterm plan, which is also subject to periodic review. In addition, the Board of Directors receives a status update on investor relations on a regular basis.

Group Internal Audit

Group Internal Audit reports functionally directly to the Chair of the Audit Committee, but administratively to the CFO. Meetings between Group Internal Audit and the statutory auditor take place regularly. They are used to prepare for the meetings of the Audit Committee, to review the interim and final reports of the statutory auditor, and to plan and coordinate internal and external audits. Group companies are audited by Group Internal Audit based on an audit plan that is approved by the Audit Committee. Depending on the risk category, such audits are carried out on a rotational basis either annually or every second, third or fourth year. Group Internal Audit carried out 50 audit assignments (including audit follow-up reviews and internal controls testing) in the year under review. One of the focal points is the internal control system (ICS). The results of each audit are discussed in detail with the companies and (where necessary) the divisions concerned, and key measures are agreed upon. The Executive Chair, the members of the Audit Committee, the CFO, the Group General Counsel as well as the respective Division President and other line managers of the audited entity receive a copy of the audit report. Significant findings and recommendations are also presented to and discussed with the Executive Committee and the Group General Counsel during the biweekly Executive Committee meetings. A follow-up process is in place for all group internal audits, which allows efficient and effective monitoring of how the improvement measures are being implemented. Each year, the Head of Group Internal Audit compiles a report summarizing activities and results. This report is distributed to members of the Board of Directors and the members of the Executive Committee, and it is presented to the Executive Committee and the Audit Committee. It is discussed in both committees and, thereafter, reported to the Board of Directors.

Risk management and compliance

Sulzer has established and implemented a comprehensive, value- and risk-based compliance program that focuses on prevention, detection and response. It consists of the following main elements:

Strong values and building up a strong ethical and compliance culture

Sulzer puts a high priority on conducting its business with integrity, in compliance with all applicable laws and internal rules (“a clean deal or no dealˮ), and on accepting only reasonable risks. Sulzer follows a “zero-toleranceˮ compliance approach. The Board of Directors and the Executive Committee firmly believe that compliant and ethical behavior in all aspects and on all levels is a precondition for successful and sustainable business. The ethical tone is set at the top, carried through to the middle, and is transmitted to the entire organization. Sulzer also fosters a speak-up culture and encourages employees to address potentially non-compliant behaviors. Retaliation against whistleblowers acting in good faith will not be tolerated.

Risk assessment

As part of Sulzer’s integrated risk management process, compliance risks are assessed regularly and mitigated with appropriate and risk-based actions. The results are discussed both with the management and with the Audit Committee. The Audit Committee dedicates at least one full meeting per year to risk management and compliance. An overview of the main risks and corresponding mitigation measures is provided in the chapter “Risk management” of this corporate governance report.

Internal rules and tools

Sulzer has a Code of Business Conduct, which can be viewed in 18 languages at www.sulzer.com/governance (under “Code of Business Conductˮ). Every employee of the Company (including employees of newly acquired businesses) has to confirm in writing that he or she has read and understood this code, and will comply with it. Every member of the Sulzer Management Group (approximately 70 managers), the heads of the operating companies, the headquarters, regional and local compliance officers as well as the legal entity finance heads must reconfirm this compliance commitment in writing annually. Furthermore, Sulzer joined the UN Global Compact initiative in 2010. The latest Communication on Progress Report was published on August 26, 2022, and can be downloaded from www.sulzer.com/sustainability.

Rules

Although Sulzer follows a behavior- and principle-based approach, compliance directives and processes have been implemented as elements of the governance framework. Sulzer focuses on the major compliance risks, e.g.:

- Bribery and corruption risks: Sulzer has had a group-wide anti-bribery and anti-corruption program in place since 2010. This program includes a web-based process that addresses the due diligence of intermediaries, a company-wide directive for offering and receiving gifts and hospitalities, and an e-training module (in thirteen languages) to familiarize Sulzer employees with the requirements of the directive.

- Antitrust and anticompetition risks: Sulzer has an antitrust directive addressing behaviors in trade associations in place.

- Export control risks: Employees involved in export activities have to comply with all applicable export and re-export laws and regulations. Sulzer rolled out and implemented its global Trade Control Directive in all legal entities concerned. Every exporting legal entity has an internal control program (ICP) in place that includes processes and defines responsibilities on export control matters and other important requirements to comply with export compliance laws and regulations.

- Further risks (e.g. non-compliance with stock exchange laws and regulations; human resource-related issues; insufficient protection of intellectual property and know-how; violations of privacy and data protection laws; product liability; risk related to environment, quality, safety and health, etc.): Focused rules and processes address these and many other potential risks. Sulzer has processes that ensure compliance with insider laws as well as stock exchange reporting and notification duties. Local compliance officers performed 27 face-to-face compliance training sessions. Due to the COVID-19 preventive measures, face-to-face sessions have been replaced by 13 compliance webinars, conducted by Group Compliance and covering 1’924 employees. In addition, 36 export control trainings have been provided.

Tools

Sulzer has a compliance hotline and an incident reporting system that provides employees with one of many options for reporting (potential) violations of laws or internal rules. Reports can be made anonymously or openly via a free hotline or a dedicated website. The Company has a directive that sets clear rules for internal investigations. Further tools are available to all employees on Sulzer’s intranet (e.g. presentations addressing the major exposures, draft agreements, sales and procurement handbooks with compliance-specific explanations and standard clauses). Sulzer has a compliance risk assessment process in place to identify and assess potential compliance risks on a local entity level and to define appropriate measures. For newly acquired companies, Sulzer sets up a post-merger integration process consisting of a systematic post-merger compliance risk analysis, which provides the foundation for risk-based mitigation actions.

Organization

Since 2013, Sulzer has had a Legal, Compliance and Risk Management group function (headed by the Group General Counsel). Within this organization, a line reporting structure is in place for the three regions: Americas (AME); Europe, the Middle East and Africa (EMEA); and Asia-Pacific (APAC). The local Compliance Officers ultimately report – via Regional Compliance Officers and the Chief Compliance Officer – to the Group General Counsel. In addition, the headquartered Compliance and Risk Management team steers and runs the group-wide compliance program and all compliance investigations. To ensure the consistent rollout of Group Compliance initiatives, the compliance organization uses direct reporting lines. The Group General Counsel informs the Board of Directors and the Executive Committee regularly about legal matters and key changes in legislation that may affect Sulzer, as well as on important litigation. Twice a year, the Audit Committee receives a report about any pending or threatened litigation with worst-case exposure exceeding CHF 0.5 million. Further information on reports to the Audit Committee is provided in the “Audit Committeeˮ section above.

Awareness building and trainings

Sulzer puts substantial effort into training its employees. Training is carried out through e-learning programs (new programs are rolled out and existing programs are updated every year), in person or through web conferences. In 2022, Sulzer employees completed 21’797 compliance e-learning courses.

Controls and sanctions

The Group Function Legal supports the audits done by Group Internal Audit following the same audit process. The Group Function Environment, Safety and Health (ESH) organized 7 external health and safety compliance audits. The focal points were occupational health and safety compliance with applicable regulations. The results of each of these audits were discussed directly with the responsible managers, and an agreement was reached on any improvements required. Audit actions are reported in a central repository (group tool) that enables the follow-up and tracking of closures and is regularly reviewed by management. The latest status of the Company’s risks relating to environment, safety and health is reported to the Audit Committee once a year. Apart from these formal audits, internal investigations (triggered by reports from the compliance hotlines, e-mails, telephone calls or other avenues of communication) were carried out during 2022 and at least 17 employees had to leave Sulzer because of violations of Sulzer’s Code of Business Conduct. Others received warnings or faced other disciplinary measures. However, most of the reports received concerned non-material issues.

Continuous improvement

It is Sulzer’s goal to constantly improve its compliance and risk management approach. Findings of audits and internal investigations are assessed, internal processes and rules are adjusted, and training modules are improved. Sulzer always reviews compliance violations to determine whether they are rooted in a process weakness. If that is found to be the case, the process will be improved and risk-mitigating measures will be taken.