Compensation of the Executive Committee for 2023

Compensation of the Executive Committee: overview

In 2023, the Executive Committee received a total compensation1 in the amount of kCHF 13’808 (previous year: kCHF 11’536). Of this total, kCHF 8’599 was in base salary and bonus (previous year: kCHF 6’947); kCHF 3’231 was in PSUs (previous year: kCHF 2’822); kCHF 1’892 was in pension and social security contributions (previous year: kCHF 1’649), and kCHF 86 was in other payments (previous year: kCHF 118).

Regarding the combined role of the Chair of the Board of Directors and the CEO, there are no changes for 2023. The remuneration of both roles remains separate in accordance with market practice, except that Suzanne Thoma participates in the Performance Share Plan as CEO only and is not granted any RSUs as Chair of the Board of Directors.

1) Including compensation granted to former members of the Executive Committee.

Compensation of the Executive Committee

|

|

|

2023 |

||||||||||||

|

|

|

Cash compensation |

|

Deferred compensation based on future performance |

||||||||||

|

thousands of CHF |

|

Base salary |

|

Bonus 2) |

|

Other 3) |

|

Pension and social security contributions 4) |

|

Total cash-based compensation |

|

Estimated value of share-based grant under the performance share plan (PSP) 5) |

|

Total (incl. conditional share-based grant) |

|

Highest single compensation, Suzanne Thoma, CEO |

|

950 |

|

1’314 |

|

- |

|

395 |

|

2’659 |

|

1’129 |

|

3’788 |

|

Total Executive Committee 1) |

|

4’201 |

|

4’398 |

|

86 |

|

1’892 |

|

10’577 |

|

3’231 |

|

13’808 |

1) Out of the total sum, kCHF 1’827 was paid to one former member of the Executive Committee, Frédéric Lalanne, former CEO. In 2023, no other payments to former members of the Executive Committee were made.

2) Expected bonus for the performance years 2023, to be paid out in the following year (accrual principle).

3) Other consists of schooling allowances, tax services and child allowances.

4) Includes the employer contribution to social security (including the expected employer contributions on equity awards), based on the fair value of all grants made in 2023 (PSP).

5) Represents the full fair value of the PSUs granted under the PSP in 2023. PSUs granted in 2023 had a fair value of CHF 88.38 at grant date, based on a third-party fair value calculation. While the share price to convert the grant value into a number of granted PSUs is based on the three-month weighted average share price before the grant date (CHF 78.26 per PSU for April 2023 grants), the disclosed fair values are calculated on the grant dates by using market value approaches, which typically leads to differences between the original grant value according to the compensation architecture and the disclosed fair market values.

|

|

|

2022 |

||||||||||||

|

|

|

Cash compensation |

|

Deferred compensation based on future performance |

||||||||||

|

thousands of CHF |

|

Base salary |

|

Bonus 2) |

|

Other 3) |

|

Pension and social security contributions 4) |

|

Total cash-based compensation |

|

Estimated value of share-based grant under the performance share plan (PSP) 5) |

|

Total (incl. conditional share-based grant) |

|

Highest single compensation, Frédéric Lalanne, CEO from February 18 2022 to October 31 2022 |

|

760 |

|

736 |

|

8 |

|

349 |

|

1’853 |

|

1’074 |

|

2’927 |

|

Suzanne Thoma, CEO since November 1st 2022 |

|

158 |

|

142 |

|

- |

|

61 |

|

361 |

|

179 |

|

540 |

|

Total Executive Committee 1) |

|

3’767 |

|

3’180 |

|

118 |

|

1’649 |

|

8’714 |

|

2’822 |

|

11’536 |

1) The total Executive Committee compensation for 2022 includes the compensation of Frederic Lalanne, Division President Flow Equipment since January 2019 until February 2022, CEO since February 2022 until October 2022; Suzanne Thoma, CEO since November 2022; Thomas Zickler, CFO since May 2022; Tim Schulten, Division President Services since January 2022; Torsten Wintergerste, Division President Chemtech since June 2016; Armand Sohet, Chief Human Resources Officer since March 2016 until December 2022; Greg Poux-Guillaume, CEO since December 2015 until February 2022; Jill Lee, CFO since April 2018 until April 2022; and Daniel Bischofberger, Division President Services since September 2016 until February 2022.

2) Expected bonus for the performance year 2022, to be paid out in the following year (accrual principle).

3) Other consists of schooling allowances, tax services and child allowances.

4) Includes the employer contribution to social security (including the expected employer contributions on equity awards), based on the fair value of all grants made in 2022 (PSP).

5) Represents the full fair value of the PSUs granted under the PSP in 2022, respectively. PSUs granted in 2022 had a fair value of CHF 84.69 at grant date, based on a third-party fair value calculation. While the share price to convert the grant value into a number of granted PSUs is based on the three-month weighted average share price before the grant date (CHF 78.84 per PSU for April 2022 grants), the disclosed fair values are calculated on the grant dates by using market value approaches, which typically leads to differences between the original grant value according to the compensation architecture and the disclosed fair market values. Suzanne Thoma received a pro-rata grant of PSU in November 2022.

No severance payments were issued to members of the Executive Committee in either the current reporting year or the prior year. No compensation was granted to any related parties of the members of the Executive Committee in the current reporting year or the prior year.

As of December 31, 2023, and December 31, 2022, there were no outstanding loans or credits granted to the members of the Executive Committee, former members of the Executive Committee or related parties.

The total compensation1 of kCHF 13’808 awarded to the members of the Executive Committee for the 2023 financial year is within the maximum aggregate compensation amount of kCHF 17’500 that was approved by the shareholders at the AGM 2022.

1) Including compensation granted to former members of the Executive Committee.

Compensation for the Executive Committee: pay-for-performance assessment

In the following, we elaborate further on how the relevant business performance impacted the variable compensation models of our Executive Committee. More detailed information about Sulzer’s operational and strategic performance in 2023 can be found in the financial report.

a) Total compensation and pay for performance ratio

In 2023, the Executive Committee received total compensation in the amount of kCHF 13’808 (previous year: kCHF 11’536). This was an overall increase of 19.7% from the previous year, resulting in part from changes in the Executive Committee members but mainly driven by the increase in financial and individual performance. This is especially highlighted by the increase of the average overall bonus payout from 109.7% in 2022 to 143.1% in 2023.

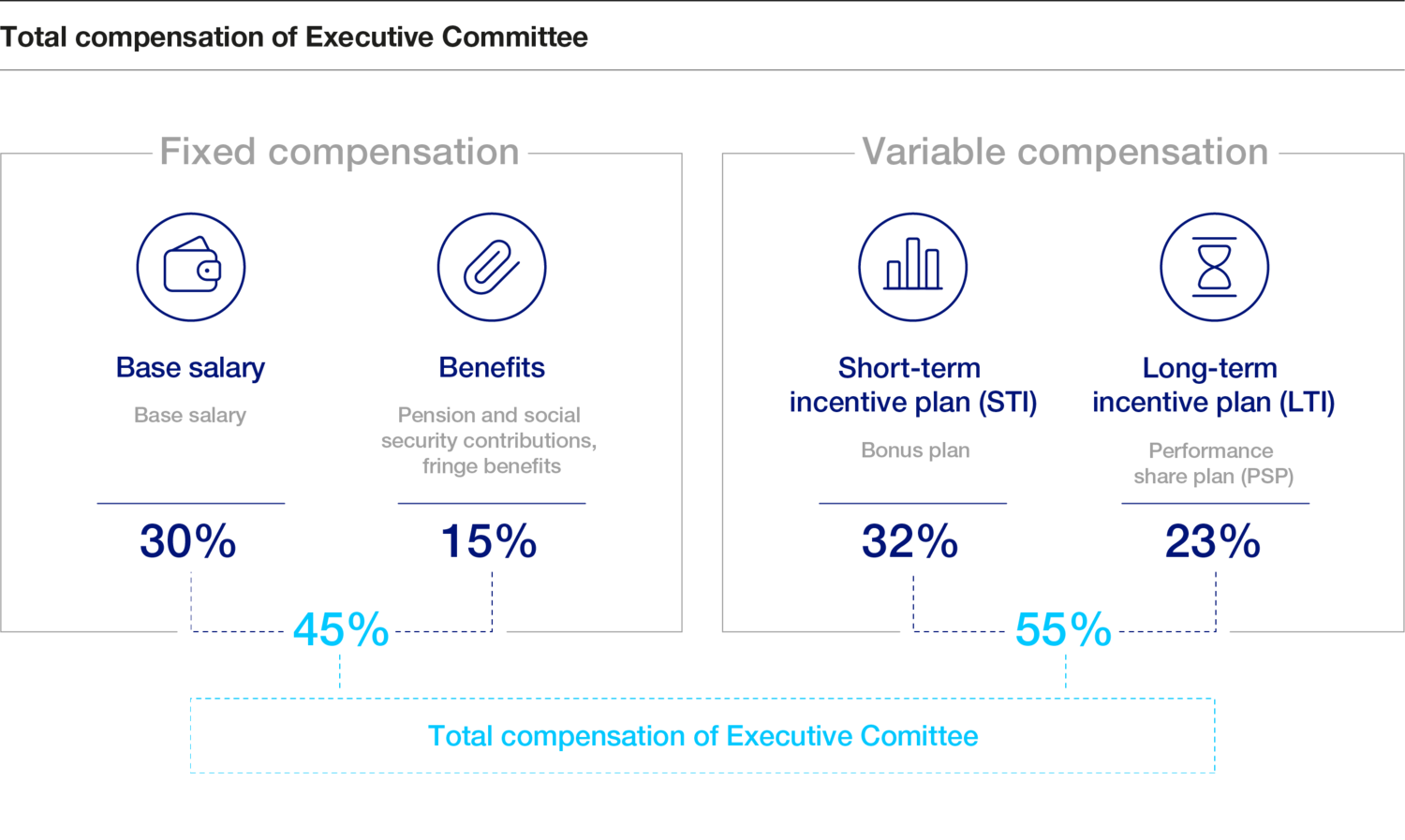

For the entire active Executive Committee, the variable component amounted to between 116.4% and 181.7% of the fixed component (base salary, other, pension and social security contributions). This pay-for-performance relation reflects Sulzer’s high-performance orientation. Further, it represents the company’s strong emphasis on aligning the interests of the Executive Committee and the shareholders to create long-term shareholder value and profitable growth. Regarding cash bonus payments and LTI amounts, see the following paragraphs.

b) Short-term incentive (cash bonus payouts)

In 2022, the RC made adjustments to the bonus due to the closure of sites in Poland from sanctions and the abandonment of operations in Russia. As of September 2, 2023, our two entities in Poland have been removed from the Polish sanctions list, allowing us to resume our direct business activities. Therefore, no adjustments to the bonuses were made in 2023.

The financial component of the bonus for 2023 ranged from 128.2% to 160.4% of targeted payout (on average 153.8%), thanks also to a high level of achievement of individual objectives. The financial performance at the group level was as follows:

|

KPI |

|

Weighting |

|

Payout factor |

|

Sales |

|

25% |

|

119% |

|

Operational profitability |

|

25% |

|

156% |

|

Operational ONCF |

|

20% |

|

200% |

|

Total |

|

70% |

|

155% |

The individual performance ranged from 90% to 150%.

In aggregate, the financial and individual performance translated into an overall bonus payout factor ranging from 122.7% to 153.7% (on average 143.1%) for the members of the Executive Committee.

c) Long-term incentive (PSP)

We are convinced that the conditional awards to receive Sulzer shares, subject to operational return on average capital employed adjusted (operational ROCEA), operating income before restructuring, amortization, impairments and non-operational items (operational profit) growth and relative total shareholder return (TSR) performance, as well as ongoing employment through the three-year vesting period:

- constitutes a fair and very attractive element of variable long-term remuneration for our key management;

- supports and underlines the company’s focus on excellent, sustainable performance;

- and provides for a strong alignment of interests with shareholders – also in the longer term.

The PSP framework (apart from the specific performance targets for each grant cycle), eligibility and grant entitlement remained unchanged in 2023 compared to previous years. The relevant key performance indicators (KPIs) were operating income before restructuring, amortization, impairments and non-operational items (operational profit), operational return on average capital employed adjusted (operational ROCEA) and relative total shareholder return (TSR) over the three-year measurement period from 2021 to 2023.

Over this three-year period, Sulzer grew its operational profit, demonstrating strong resilience by overcoming the COVID related challenges during these years, the exit from the Russian market and the supply chain disruptions in 2022, but also by leveraging the market momentum in 2023. This performance resulted in an achievement factor of 250%, compared to the original PSP target set by the Board of Directors.

Operational ROCEA also reported an achievement factor of 250%, improved to a continued high average over the three-year period, on the back of the improved profitability and the well managed capital employed.

Together with a relative TSR achievement factor of 220%, which compared Sulzer’s share price development against international peers over the PSP 2021 measurement period, the resultant total payout factor is 235% for the PSP 2021.

The payout factor results and respective weighting are as follows:

|

KPI |

|

Weighting |

|

Payout factor |

|

Operational profit growth |

|

25% |

|

250% |

|

Operational ROCEA |

|

25% |

|

250% |

|

Relative TSR |

|

50% |

|

220% |

|

Total |

|

100% |

|

235% |

Overall, the PSP vesting levels fairly reflected the operational performance, also against direct peers, over their respective three-year performance cycles, especially considering the exceptional external influences which have been successfully mitigated. Therefore, Sulzer fully achieved the desired strong link between sustainable company performance and competitive long-term incentive payouts.

Shareholdings of the members of the Executive Committee

As of the end of 2022 and 2023, the members of the Executive Committee held the following shares, share-based instruments or options in the company:

Shareholdings at December 31, 2023

|

|

|

2023 |

||||||

|

|

|

Sulzer shares |

|

Share units under vesting in equity plan |

||||

|

|

|

Sulzer shares 1) |

|

Performance share units (PSU) 2021 |

|

Performance share units (PSU) 2022 |

|

Performance share units (PSU) 2023 |

|

Executive Committee |

|

11’114 |

|

4’264 |

|

14’362 |

|

36’548 |

|

Suzanne Thoma, CEO |

|

2’559 |

|

- |

|

2’120 |

|

12’778 |

|

Thomas Zickler, CFO |

|

3’402 |

|

1’212 |

|

5’074 |

|

5’112 |

|

Haining Auperin, CHRO |

|

5’153 |

|

1’364 |

|

1’142 |

|

4’217 |

|

Tim Schulten, Division President Services |

|

- |

|

1’212 |

|

5’074 |

|

5’112 |

|

Jan Lüder, Division President Flow Equipment |

|

- |

|

- |

|

- |

|

5’112 |

|

Uwe Boltersdorf, Division President Chemtech |

|

- |

|

476 |

|

952 |

|

4’217 |

1) Total shares in all individual accounts, collected through the Corporate Governance Questionnaire. No related parties own any shares.

Shareholdings at December 31, 2022

|

|

|

2022 |

||||||

|

|

|

Sulzer shares |

|

Share units under vesting in equity plan |

||||

|

|

|

Sulzer shares |

|

Performance share units (PSU) 2020 |

|

Performance share units (PSU) 2021 |

|

Performance share units (PSU) 2022 |

|

Executive Committee |

|

32’723 |

|

16’827 |

|

12’412 |

|

20’640 |

|

Suzanne Thoma |

|

744 |

|

- |

|

- |

|

2’120 |

|

Thomas Zickler |

|

1’513 |

|

1’273 |

|

1’212 |

|

5’074 |

|

Armand Sohet |

|

6’791 |

|

7’777 |

|

4’994 |

|

4’186 |

|

Tim Schulten |

|

- |

|

- |

|

1’212 |

|

5’074 |

|

Torsten Wintergerste |

|

23’675 |

|

7’777 |

|

4’994 |

|

4’186 |

No member of the Executive Committee held any options.