– Compensation report – Compensation of the Executive Committee for 2022

Compensation of the Executive Committee for 2022

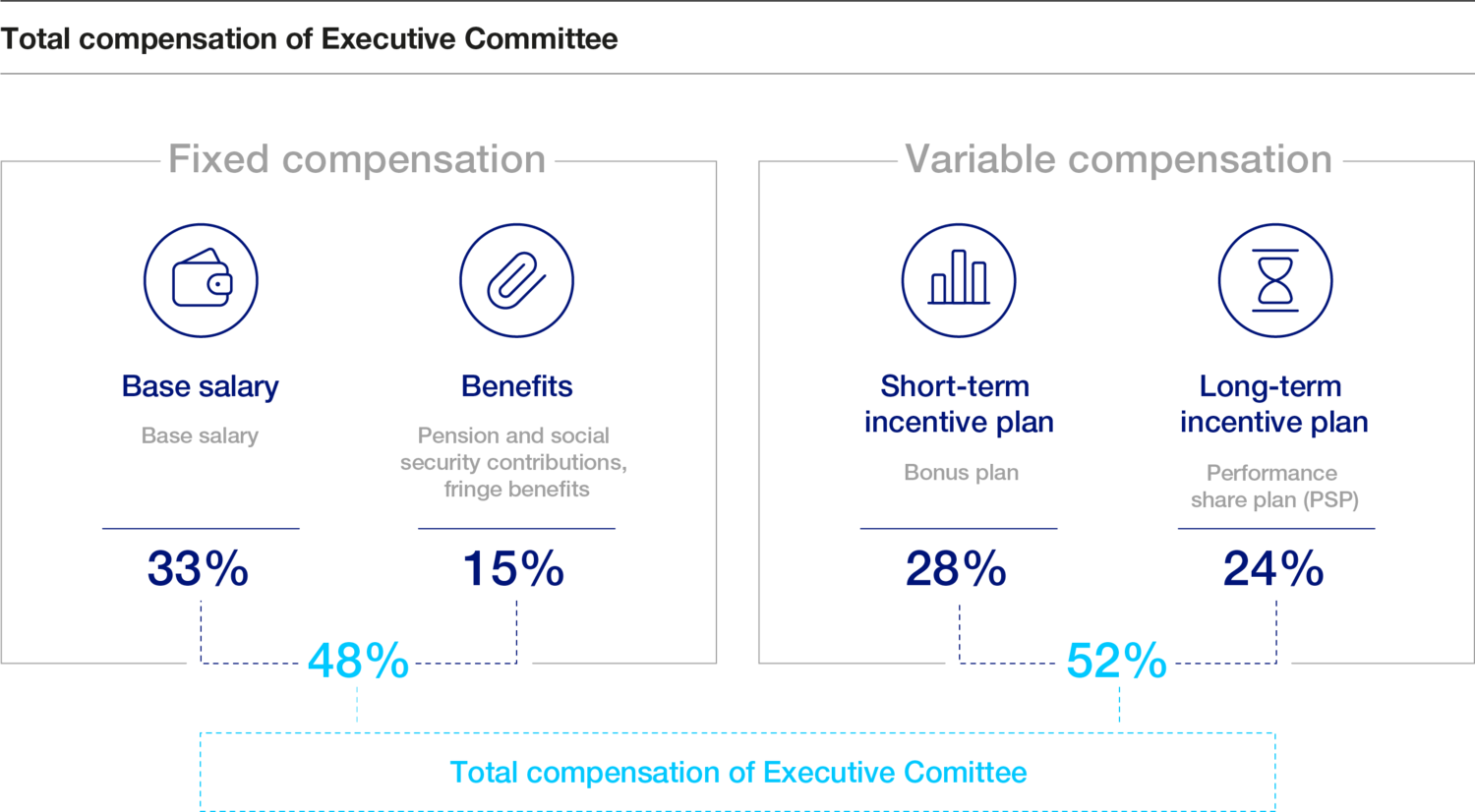

Compensation of the Executive Committee: overview

In the course of establishing the combined role of the Chairwoman of the Board of Directors and the CEO, compensation for both roles was revised in autumn 2022. Three clear principles were followed by the Board of Directors in order to establish remuneration for the combined role:

- Firstly, market practice was considered to ensure that the remuneration of the Chairwoman as well as the CEO function are in line with the revised benchmarks.

- Secondly, the role of Chairwoman and the role of CEO are considered separately. Nevertheless, with the combined role, Suzanne Thoma participates in the Performance Share Plan as CEO only, but is not granted RSU as Chairwoman of the Board of Directors.

- Thirdly, the combined remuneration for the Chairwoman and CEO roles were positioned to be below the average remuneration observed for the CEO role alone in recent years.

In 2022, the Executive Committee received total compensation in the amount of kCHF 11’536 (previous year: kCHF 14’609). Of this total, kCHF 6’947 was in cash (previous year: kCHF 8’027); kCHF 2’822 was in PSUs (previous year: kCHF 4’486); kCHF 1’649 was in pension and social security contributions (previous year: kCHF 1’938), and kCHF 118 was in other payments (previous year: kCHF 158).

Compensation of the Executive Committee

|

|

|

2022 |

||||||||||||

|

|

|

Cash compensation |

|

Deferred compensation based on future performance |

||||||||||

|

thousands of CHF |

|

Base salary |

|

Bonus 2) |

|

Other 3) |

|

Pension and social security contributions 4) |

|

Total cash-based compensation |

|

Estimated value of share-based grant under the performance share plan (PSP) 5) |

|

Total (incl. conditional share-based grant) |

|

thereof highest single compensation, Frédéric Lalanne, CEO from February 18, 2022 to October 31, 2022 |

|

760 |

|

736 |

|

8 |

|

349 |

|

1’853 |

|

1’074 |

|

2’927 |

|

Suzanne Thoma, CEO since November 1, 2022 |

|

158 |

|

142 |

|

0 |

|

61 |

|

361 |

|

179 |

|

540 |

|

Total Executive Committee 1) |

|

3’767 |

|

3’180 |

|

118 |

|

1’649 |

|

8’714 |

|

2’822 |

|

11’536 |

|

|

|

2021 |

||||||||||||

|

|

|

Cash compensation |

|

Deferred compensation based on future performance |

||||||||||

|

thousands of CHF |

|

Base salary |

|

Bonus 2) |

|

Other 3) |

|

Pension and social security contributions 4) |

|

Total cash-based compensation |

|

Estimated value of share-based grant under the performance share plan (PSP) 5) |

|

Total (incl. conditional share-based grant) |

|

Highest single compensation, Greg Poux-Guillaume, CEO |

|

1’021 |

|

1’500 |

|

87 |

|

461 |

|

3’069 |

|

1’779 |

|

4’849 |

|

Total Executive Committee |

|

3’931 |

|

4’096 |

|

158 |

|

1’938 |

|

10’123 |

|

4’486 |

|

14’609 |

1) The total Executive Committee compensation for 2022 and 2021 includes the compensation of Frederic Lalanne, Division President Flow Equipment since January 2019 until February 2022 and as CEO since February 2022 until October 2022; Suzanne Thoma, CEO since November 2022; Thomas Zickler, CFO since May 2022; Tim Schulten, Division President Services since January 2022; Torsten Wintergerste, Division President Chemtech since June 2016; Armand Sohet, Chief Human Resources Officer since March 2016; Greg Poux-Guillaume, CEO since December 2015 until February 2022; Jill Lee, CFO since April 2018 until April 2022; Daniel Bischofberger, Division President Services since September 2016 until February 2022; Girts Cimermans, Division President Applicator Systems since October 21, 2019 until September 19, 2021.

2) Expected bonus for the performance years 2022 and 2021 respectively, to be paid out in the following year (accrual principle).

3) Other consists of schooling allowances, tax services and child allowances.

4) Includes the employer contribution to social security (including the expected employer contributions on equity awards), based on the fair value of all grants made in 2022 and 2021, respectively (PSP).

5) Represents the full fair value of the PSUs granted under the PSP in 2022 and 2021, respectively. PSUs granted in 2022 had a fair value of CHF 84.69 at grant date, based on a third-party fair value calculation. While the share price to convert the grant value into a number of granted PSUs is based on the three-month weighted average share price before the grant date (CHF 78.84 per PSU for April 2022 grants), the disclosed fair values are calculated on the grant dates by using market value approaches, which typically leads to differences between the original grant value according to the compensation architecture and the disclosed fair market values. Suzanne Thoma received a pro-rata grant of PSU in November 2022.

The total compensation of kCHF 11’536 awarded to the members of the Executive Committee for the 2022 financial year is within the maximum aggregate compensation amount of kCHF 19’500 that was approved by the shareholders at the 2021 AGM.

No severance payments to members of the Executive Committee were made during the reporting year.

As of December 31, 2021, and December 31, 2022, there were no outstanding loans or credits granted to the members of the Executive Committee, former members of the Executive Committee or related parties.

In 2022, no compensation was granted to former members of the Executive Committee. In 2022, no compensation was granted to any related parties.

Compensation for the Executive Committee: pay-for-performance assessment

In the following, we elaborate further on how the relevant business performance impacted the variable compensation models of our Executive Committee. More detailed information about Sulzer’s operational and strategic performance in 2022 can be found in the financial report.

a) Total compensation and pay for performance ratio

In 2022, the Executive Committee received total compensation in the amount of kCHF 11’536 (previous year: kCHF 14’609). This was an overall decrease of 21.0% from the previous year. The decrease was mainly due to a reduction in Executive Committee members associated with the ad interim dual role of CEO and Division President Flow Equipment in 2022, as well as the post-spin-off departure of the Division President of Sulzer’s Applicator Systems division. In addition, the LTI target for the CEO decreased from kCHF 1’440 in previous years to kCHF 1’000 from 2022 onwards.

For the entire Executive Committee, the variable component amounted to between 43.7% and 162.1% of the fixed component (base salary, other, pension and social security contributions). This pay-for-performance relation reflects Sulzer’s high-performance orientation. Further, it represents the company’s strong emphasis on aligning the interests of the Executive Committee and the shareholders to create long-term shareholder value and profitable growth. On a like-for-like basis (Executive Committee members employed in both 2022 and 2021), the base salaries of the Executive Committee members remained unchanged. Regarding cash bonus payments and LTI amounts, see the following paragraphs.

b) Short-term incentive (cash bonus payouts)

Despite the direct impact of the Polish sanctions, and the need to close down our operations in that country and our exit from Russia, the Board of Directors decided not to revise the financial targets during the year and to keep the budget at the same level. However, the Board of Directors kept the possibility of assessing the consolidated impact of the closure of sites in Poland and the withdrawal from Russia. This review was carried out in December and led to the following results: the impact of the situation affected sales by 2.6% and profitability by 6.9%.

The RC decided to make an adjustment to the bonus, which affects 5’000 employees in the company. This adjustment neutralizes the effect of lost volumes and costs incurred in winding down the businesses in Russia while engaging in negotiations to sell the businesses and of the reduced sales and costs incurred of relocating production from Poland to other sites. Overall, the adjustment led to an increase in target achievement of financial performance indicators of 18% and raised the initial payout from 81% to 99%. The Board of Directors is of the opinion that the Executive Committee and the whole business made best efforts to handle the situation in Poland and Russia and should not be held accountable for the resulting bonus decrease. The developments were neither foreseeable nor influenceable by the members of the Executive Committee.

The financial component of the bonus for 2022 ranged from 86.1% to 135.4% of targeted payout (on average 101.1%), thanks also to a high level of achievement of individual objectives. The financial performance on group level was as follows:

|

KPI |

|

Weighting |

|

Payout factor |

|

Sales |

|

25% |

|

112% |

|

Operational profitability |

|

25% |

|

147% |

|

Operational ONCF |

|

20% |

|

24% |

|

Total |

|

70% |

|

99% |

The individual performance ranged from 100% to 158% to consider the exceptional team performance.

In aggregate, the financial and individual performance translated into an overall bonus payout factor ranging from 99.3% to 124.8% (on average 109.7%) for the members of the Executive Committee.

c) Long-term incentive (PSP)

We are convinced that the conditional awards to receive Sulzer shares, subject to operational return on average capital employed adjusted (operational ROCEA), operating income before restructuring, amortization, impairments and non-operational items (operational profit) growth and relative total shareholder return (TSR) performance, as well as ongoing employment through the three-year vesting period:

- constitutes a very attractive element of variable long-term remuneration for our key management;

- supports and underlines the company’s focus on excellent, sustainable performance;

- and provides for a strong alignment of interests with shareholders – also in the longer term.

The PSP framework (apart from the specific performance targets for each grant cycle), eligibility and grant entitlement remained unchanged in 2022 compared to previous years. The relevant key performance indicators (KPIs) were operating income before restructuring, amortization, impairments and non-operational items (operational profit growth), operational return on average capital employed adjusted (operational ROCEA) and relative total shareholder return (TSR) over the three-year measurement period from 2020 to 2022.

Over this three-year period, operational profit adjusted for foreign exchange and M&A impacts grew by 34% even as we had to navigate unexpected and challenging impacts from COVID-19 in 2021 and the war in Ukraine in 2022. Compared to the PSP target set by the Board of Directors, this resulted in an achievement factor of 250%.

Operational ROCEA has continued to improve from an already high level over the past three years, thanks to our determined drive for operational excellence, strict management of capital expenditures and efforts to optimize our footprint. For the maximum 250% target achievement of operational ROCEA, the Board of Directors considered the unknown effects of COVID-19 and allowed a decline of 30 bps over the course of the PSP 2020 measurement period to a still comparatively high level of 21.7%. An actual achievement of 250% was realized.

Together with a relative TSR achievement factor of 138%, which compared Sulzer’s share price development against international peers as well as against the SMIM over the PSP 2020 measurement period, the resultant total payout factor is 194% for the PSP 2020.

The payout factor results and respective weighting are as follows:

|

KPI |

|

Weighting |

|

Payout factor |

|

Operational profit |

|

25% |

|

250% |

|

Operational ROCEA |

|

25% |

|

250% |

|

Relative TSR |

|

50% |

|

138% |

|

Total |

|

100% |

|

194% |

Overall, the PSP vesting levels fairly reflected the operational performance, also against direct peers, over the respective three-year performance cycles, especially in light of the exceptional external influences which have been successfully mitigated. Therefore, Sulzer fully achieved the desired strong link between sustainable company performance and competitive long-term incentive payouts.

Shareholdings of the Executive Committee

As of the end of 2020, 2021 and 2022, the members of the Executive Committee held the following shares in the company:

Shareholdings at December 31, 2022

|

|

|

2022 |

||||||

|

|

|

Sulzer shares |

|

Share units under vesting in equity plan |

||||

|

|

|

Sulzer shares |

|

Performance share units (PSU) 2020 |

|

Performance share units (PSU) 2021 |

|

Performance share units (PSU) 2022 |

|

Executive Committee |

|

32’723 |

|

16’827 |

|

12’412 |

|

20’640 |

|

Suzanne Thoma |

|

744 |

|

- |

|

- |

|

2’120 |

|

Thomas Zickler |

|

1’513 |

|

1’273 |

|

1’212 |

|

5’074 |

|

Armand Sohet |

|

6’791 |

|

7’777 |

|

4’994 |

|

4’186 |

|

Tim Schulten |

|

- |

|

- |

|

1’212 |

|

5’074 |

|

Torsten Wintergerste |

|

23’675 |

|

7’777 |

|

4’994 |

|

4’186 |

Shareholdings at December 31, 2021

|

|

|

2021 |

||||||

|

|

|

Sulzer shares |

|

Share units under vesting in equity plans (RSU and PSP) |

||||

|

|

|

Sulzer shares |

|

Performance share units (PSU) 2019 |

|

Performance share units (PSU) 2020 |

|

Performance share units (PSU) 2021 |

|

Executive Committee |

|

77’941 |

|

81’932 |

|

94’735 |

|

49’936 |

|

Greg Poux-Guillaume |

|

43’000 |

|

35’746 |

|

50’900 |

|

21’789 |

|

Daniel Bischofberger |

|

9’720 |

|

9’932 |

|

9’427 |

|

6’053 |

|

Frederic Lalanne |

|

6’797 |

|

9’932 |

|

9’427 |

|

6’053 |

|

Jill Lee |

|

5’084 |

|

9’932 |

|

9’427 |

|

6’053 |

|

Armand Sohet |

|

2’728 |

|

8’195 |

|

7’777 |

|

4’994 |

|

Torsten Wintergerste |

|

10’612 |

|

8’195 |

|

7’777 |

|

4’994 |